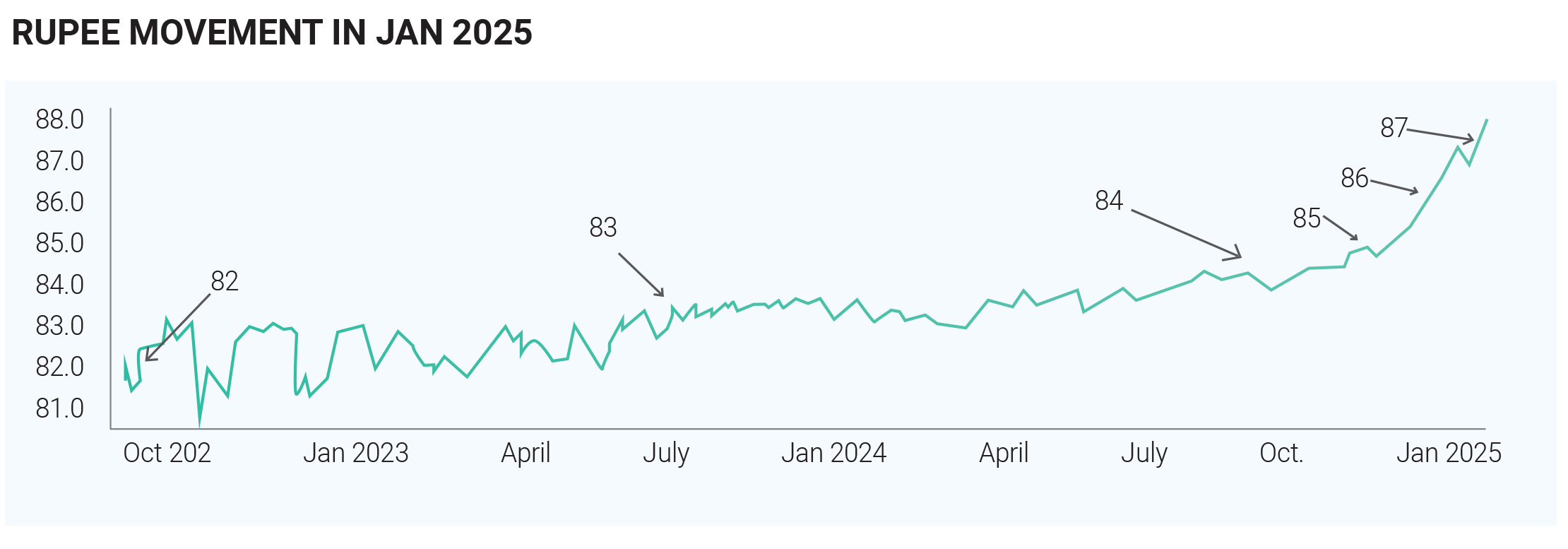

In January 2025, the Indian rupee experienced a notable depreciation against the U.S. dollar, declining from approximately ₹85.56 at the beginning of the month to around ₹86.50 by month-end. This weakening was influenced by several factors, including shifts in U.S. economic policies, key financial indicators, and interest rate decisions that bolstered the dollar's strength. Domestic challenges further exacerbated the situation. India's persistent trade deficit, particularly with China, remains a significant concern. In the fiscal year 2024, the trade deficit with China soared to $85.1 billion. Imports from China rose by 9.8% year-on-year, amounting to $65.89 billion, while exports to China dropped by 9.37%, totalling approximately $8 billion. This imbalance underscores India's reliance on Chinese imports and highlights structural vulnerabilities in its trade ecosystem. As India gears up for Budget 2025, strategic reforms aimed at reducing import dependency and strengthening domestic production are anticipated. Measures to encourage local manufacturing and enhance export competitiveness may help address these economic concerns. The rupee's depreciation was also influenced by inflationary pressures, heightened demand for dollars, trade tensions, and expectations surrounding the Reserve Bank of India's (RBI) monetary policy stance. Moving forward, interventions by the RBI and favourable domestic economic developments could contribute to stabilizing the currency in the coming months.