As the world economies were recovering from the

COVID-19 pandemic and the Russia- Ukraine war. The

world was dealing with high energy prices, global food

shortages and inflation because of the Russia-Ukraine

war. Both the developed world and the emerging

economies are growing far slower than expected. The

International Monetary Fund (IMF) estimates that global

growth will slow down from 3.5% in 2022 to 3% in 2023

and to 2.9% in 2024, well below the historical average of

3.8%.

IMF reported that despite war-disrupted energy and food

markets and unprecedented monetary tightening to

combat decades-high inflation, economic activity has

slowed but not stalled. Even so, growth remains slow and

uneven, with widening divergences. After considering the

impact of Israel Hamas war, global inflation spurted to

9.2% in the aftermath of the Russian invasion of Ukraine

and fell to 5.9% in 2023 as central banks across the world

raised as central banks across the world raised interest

rates to cool down the high prices. The IMF projected

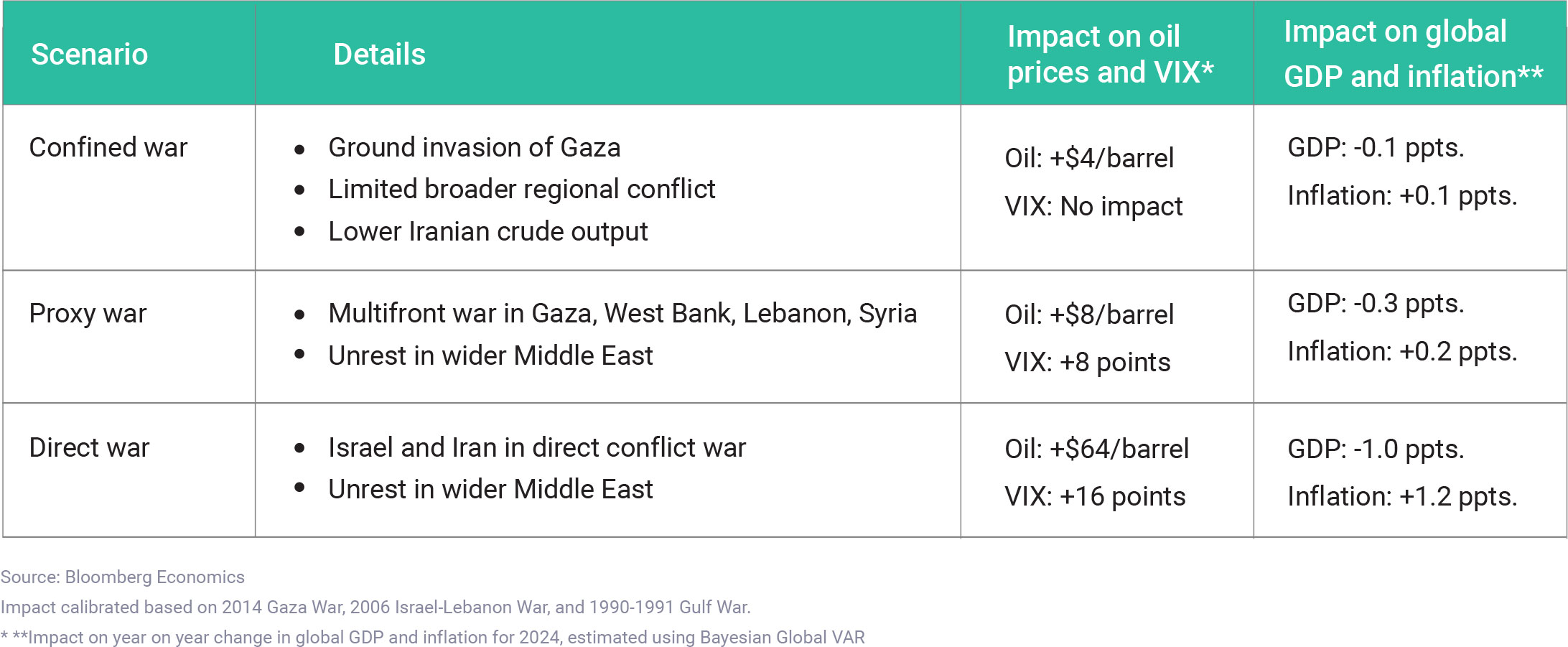

inflation at 4.8% in 2024. A report by Bloomberg

Economics considers the Israel-Hamas war's likely

impact on global growth and inflation under three

scenarios- Confined war, multifront war and direct war.

For the Indian economy, the oil prices and rising US bond

prices are major concerns. India is a net importer of

crude unstable prices would affect the future

macroeconomic stability. Currently, India continues to

have economic stability but the spike in crude prices can

put India in difficult economic conditions. The impact of

the Israel-Hamas war on India can be summaries as:

· High import bill which would widen the current account

deficit- high crude prices would worsen the government’s

fiscal deficit and widening the current account deficit

would impact currency adversely, in turn affecting

sectors like auto, aviation, paints and chemicals. Every

10-dollar rise in Brent crude prices widens India’s current

account deficit by 0.5%. Consequently depreciating the

Rupee leads to imported inflation.

· Weakens the Indian Rupee – paying for high crude oil

can increase the demand for dollars hence weakening

the rupee against the dollar.

· Oil Marketing companies incur losses- rising crude

prices would have a significant impact on some specific

stocks and the broader economy. The Indian crude oil

basket has averaged ~ $80.1 per barrel in the first five

months of FY24. Instead, the price of the Indian crude

basket touched $90.7 per barrel in the first week of

September. High international oil prices will raise the

average Indian crude basket price and the oilmarketing

companies (OMCs) including Indian Oil, Bharat

Petroleum Corp Ltd (BPCL) and Hindustan Petroleum

Corp Ltd (HPCL), will register losses in gross refinery

margins.

· Inflation pressure - According to the Reserve Bank of

India (RBI), the sustained increase in prices is expected

to lead to a lower aggregate demand as households and

firms are left with less disposable incomes to spend on

non-energy goods. This is how domestic consumer

prices respond to an oil supply news shock.

· Higher fiscal deficit – The government often subsidizes

fuel prices to protect consumers from the impact of

rising oil prices, if crude continues to rise the government

may need to subsidise a part of the price increase which

would lead to a higher fiscal deficit. The country’s GDP

numbers would be affected.

ECONOMIC IMPACT OF WAR

Global growth and inflation impact of three scenarios for how the Israel- Hamas conflict could evolve