In February 2024, the month commenced with the

unveiling of Interim Budget 2024, laying the groundwork

for targeted growth initiatives amidst economic

challenges. The market response to the Budget was

mixed. Focused on infrastructure development and fiscal

prudence, the Budget echoed the government's

commitment to fostering a stronger economy. During the

second week, the MPC meeting maintained unchanged

rates, in line with market expectations. However,

mid-month witnessed a setback as the Sensex dropped

approximately 500 points due to elevated US inflation,

sparking a sell-off in Asian markets. By month-end,

Indian equity markets rebounded, reaching all-time

highs.

The benchmark equity indices, BSE Sensex and BSE

MidCap, advanced over 1%, while the BSE SmallCap

index experienced a 1.09% retreat. Notably, at least 13

stocks listed on BSE more than doubled investors'

wealth. Following the disclosure of the country's Q3FY23

GDP growth of 8.4% on February 29, the markets

exhibited a sharp rise. On March 1, the Sensex surged

over 1,000 points in the afternoon trade, with the Nifty

index up over 300 points. Both indices achieved new

all-time highs, propelled by buying activity fuelled by

various domestic and global macroeconomic factors.

BSE Sensex reached a new record high of 73,819.21,

ultimately rallying 1,245.05 points (1.72%) to settle at

1245.05. NSE's Nifty50 surpassed the 22,350-mark for

the first time, settling at 22,338.75, reflecting a surge of

355.95 points (1.62%) for the day.

While the BSE midcap index added less than a percent,

the smallcap index rose two-thirds of a percent. The fear

gauge in India eased more than 2%, concluding the week

at 15.24 levels. Nifty IT, media, healthcare, and pharma

stocks lagged, but a rally was steered by buying in

financials, banks, metals, and auto sectors.

As the month concluded, the markets exhibited positive

momentum driven by various factors, including:

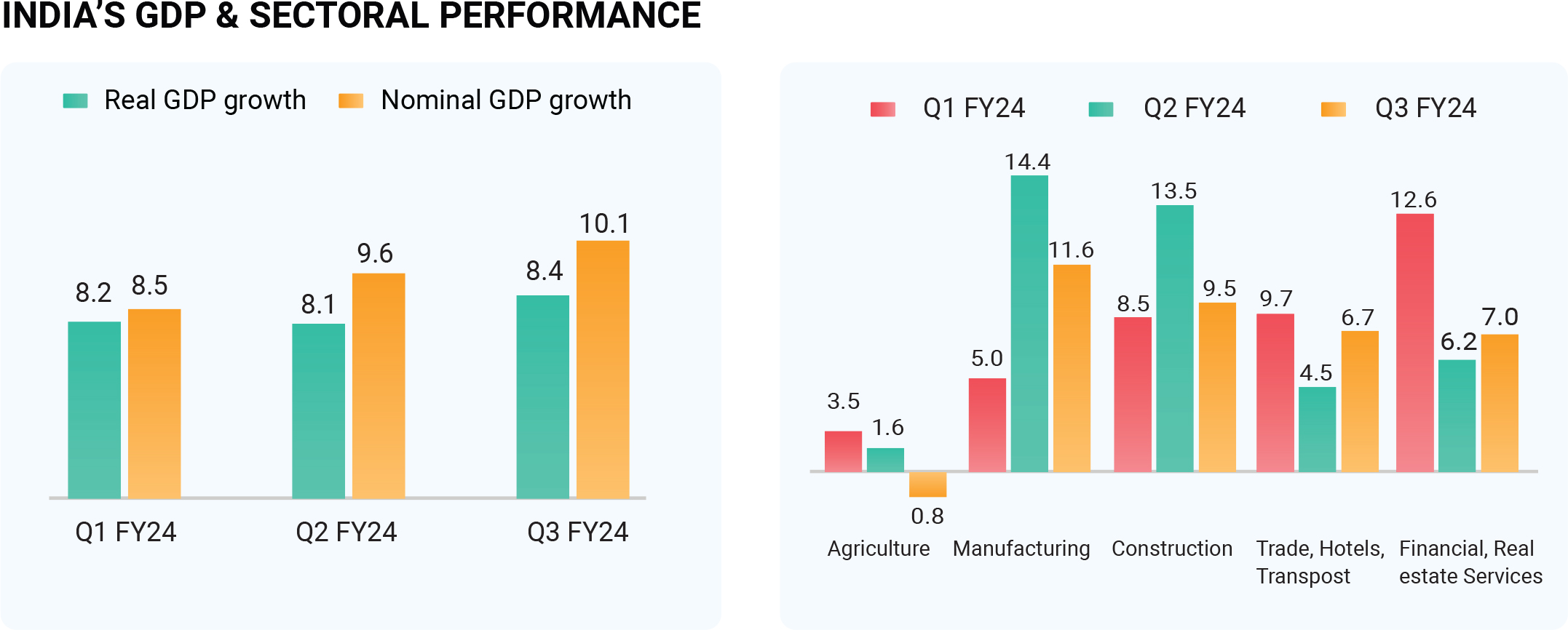

India's GDP Numbers:

The Indian economy surged, registering a growth rate of

8.4% in the December 2023 quarter, surpassing initial

estimates. This robust expansion was fuelled by a

dynamic manufacturing and construction sector,

marking the fastest economic growth in six quarters.

With a remarkable 11.6% annual growth in the

manufacturing sector and a 9.5% increase in the

construction sector in the third quarter, the FY24

estimate was revised upward to 7.6% from 7%. Despite a

contraction of 0.8% in the agriculture sector due to

adverse monsoon conditions and El-Nino impact, the

overall economic journey positions India as a favoured

destination for investors.

US Inflation Data:

US inflation eased to 2.4% in January 2024, aligning with

the US Federal Reserve's inflation target. The in-line

readings of US inflation reinforced expectations for a

potential rate cut in June. The positive economic climate

was evident as US stocks settled higher, with the Nasdaq

reaching a record high close after over two years. This

rally was fuelled by investor optimism, buoyed by

better-than-expected Core PCE numbers and the Fed's

expected inflation gauge meeting consensus forecasts.

Globally, indices remained upbeat, sustaining hopes for

central bank rate cuts in the upcoming months. Investors

expressed confidence in both the US Federal Reserve

and the European Central Bank for potentially lowering

borrowing costs in June.

Positive FII Data:

Notwithstanding Foreign Portfolio Investors (FPIs)

turning net sellers of domestic stocks on the last day of

February, the overall month displayed positive trends.

NSE data indicated FPIs selling domestic stocks worth

Rs 3,568.11 crore, while domestic institutional investors

(DIIs) divested Rs 230.21 crore in Indian equities in the

previous session. Despite these sell-offs, overseas

investors injected a total of Rs 1,539 crore into local

equities throughout February. FPIs, reversing January's

selling streak, became net buyers in February,

showcasing resilience despite the backdrop of high US

bond yields. Although the capital outflow from Indian

equities by FPIs in 2024 reached ₹20,004 crore, the

positive trend continued as FPIs infused ₹4,201 crore in

Indian equities on March 1, despite offloading ₹134 crore

from the debt market. FPIs were prominent sellers in the

financials and FMCG sectors in February, but their

outflow declined, culminating in them becoming net

buyers by the end of the month.

Blue Chip Buying and High Auto Sales:

The markets witnessed an upswing fuelled by buying in

index heavyweights. Notably, ICICI Bank, HDFC Bank,

Reliance Industries, and Larsen & Toubro collectively

contributed around 60% of the 1,245 points rally

observed in the Sensex during the session. Key gainers

included State Bank of India and Tata Steel. Indian

automakers reported strong sales in February, with

increased demand for two-wheelers and utility vehicles.

Companies such as TVS Motors, Maruti Suzuki India,

Tata Motors, Hero MotoCorp, and Bajaj Auto all

experienced positive gains.

In summary, the positive trajectory at the close of the

month was shaped by a confluence of favourable

economic indicators, robust market activities, and

investor confidence in both domestic and global

contexts. Global developments, such as upcoming

elections in India and the US, escalating crude prices,

recovery in major economies, global and domestic

macroeconomic data, geopolitical tensions, and foreign

capital inflows, have significantly impacted the market

dynamics.

In February, crude oil prices experienced a 2% increase in

the previous session, reflecting weekly gains. Traders

eagerly awaited the decision on supply agreements for

the second quarter by the Organization of the Petroleum

Exporting Countries and its allies (OPEC+). The market

sentiment was also influenced by fresh economic data

from the US, Europe, and China. Brent futures for May

settled $1.64 higher, reaching $83.55 a barrel, while the

April Brent futures contract expired at $83.62 a barrel on

February 29. Meanwhile, US West Texas Intermediate

(WTI) for April rose by $1.71 (2.19%), closing at $79.97 a

barrel, as reported by Reuters. Analysts speculated that

OPEC+ was expected to maintain voluntary production

cuts well into the second quarter of 2024. Several key

economic indicators are anticipated to impact the

market in the near future. Notable among these are

China's Caixin Services PMI, inflation figures, UK S&P

Global/CIPS Services PMI and Construction PMI, US S&P

Global Services PMI, API weekly crude oil stock, ADP

nonfarm employment change, initial jobless claims, and

the unemployment rate. While the overall market

sentiment appears positive, the possibility of volatility

cannot be overlooked, given the prominent role played by

global concerns. The market will likely remain sensitive

to developments in geopolitical landscapes, economic

data releases, and any unforeseen events that may

impact the stability of major economies and influence

investor confidence.

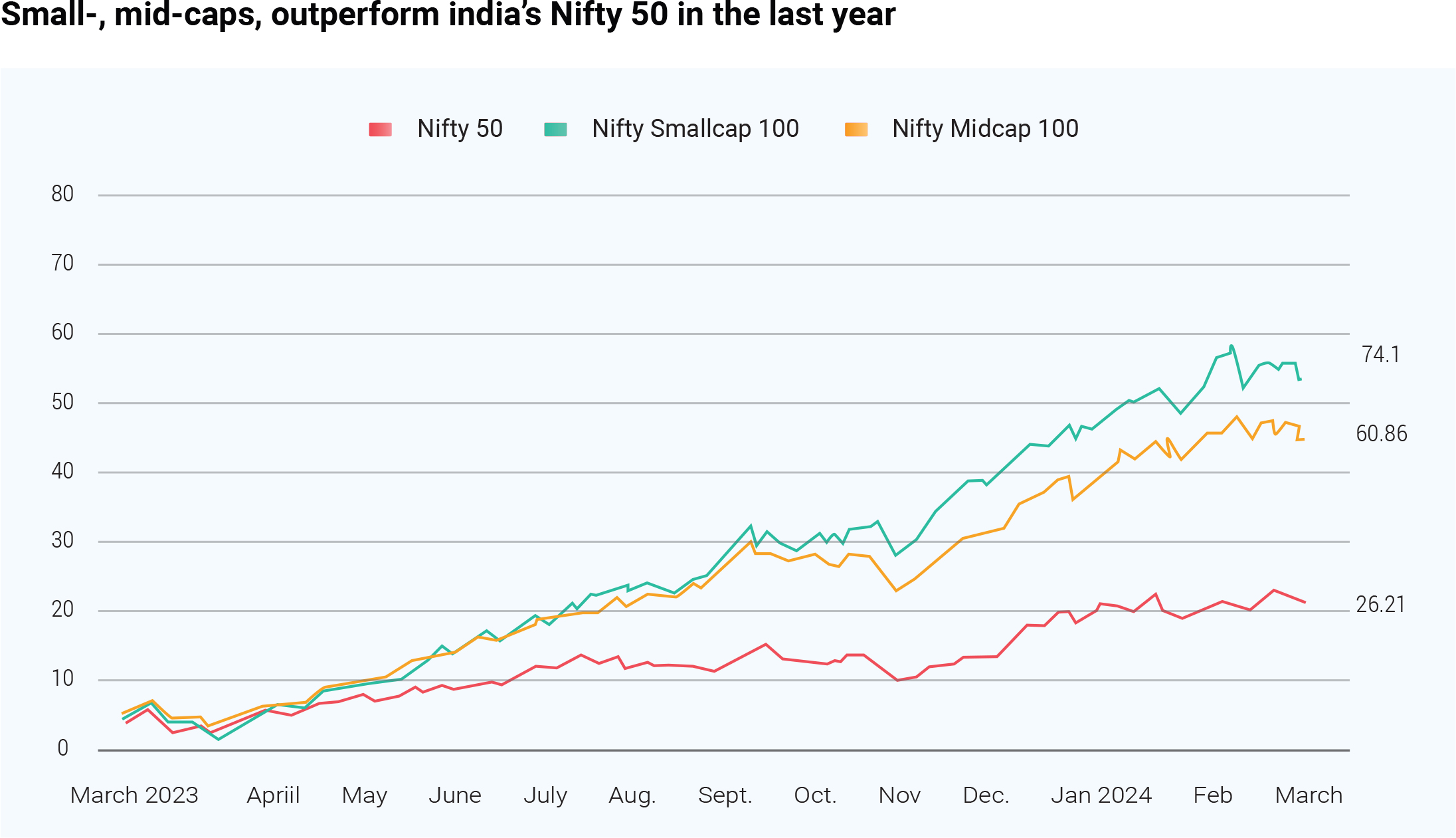

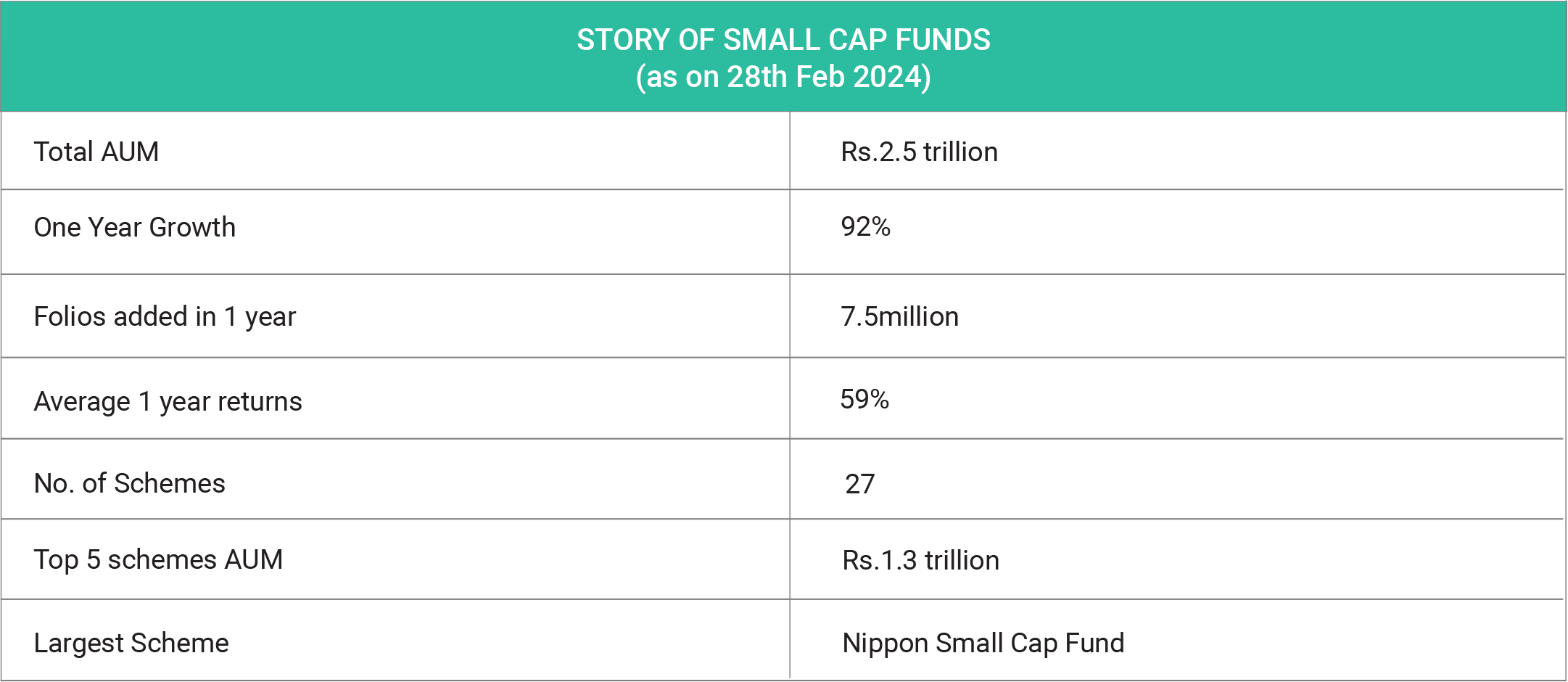

On 29th February 2024, the Securities & Exchange Board of India (SEBI), the country's market regulator, has directed money managers to implement crucial measures addressing concerns surrounding small and mid cap stock mutual funds. The move aims to manage the burgeoning froth in the broader markets and protect the interests of investors. SEBI's directive encourages money managers to consider limiting one-off investments from clients in small and mid cap funds while also reducing the commissions associated with their sale. The Association of Mutual Funds in India (AMFI) has echoed these sentiments, urging asset management companies (AMCs) to formulate policies safeguarding investors in the smallcap and midcap segments. In recent times, the Indian mutual fund industry has witnessed remarkable growth, particularly in small and mid-cap funds. The Nifty Small-Cap 100 index surged by an impressive 74% over the past 52 weeks, and the Nifty Mid-Cap 100 index also saw a substantial rise of 60.86%. These gains have significantly outpaced the benchmark Nifty's 26.21% increase over the same period, prompting regulatory bodies to take notice and address potential risks. Rapid Asset Growth: The assets managed by small-cap funds in India soared by a staggering 86.5% over a 10-month period, reaching 2.48 trillion rupees ($29.92 billion) by the end of January. Simultaneously, mid-cap funds experienced a substantial jump of 58.5%,. approaching the 2.99 trillion rupees managed by large-cap funds. This rapid asset growth has raised concerns about market froth and prompted regulatory intervention.

SEBI's Concerns and Measures: The Securities and Exchange Board of India (SEBI), the country's market regulator, expressed concerns about a potential froth in the market, especially in small-cap funds. Inflows into these funds increased by an alarming 92% in the first 10 months of the fiscal year, leading to SEBI's heightened scrutiny. To address these concerns, SEBI issued a letter to money managers, urging them to consider restricting one-off investments in small and mid-cap stock mutual funds. Additionally, SEBI recommended a reduction in commissions for the sale of these funds

Enhancing Transparency and Investor Protection: To

further safeguard investor interests, SEBI has mandated

additional risk disclosures for small and mid-cap funds.

This move aims to provide investors with a clearer

understanding of the potential risks associated with

these funds, promoting transparency and informed

decision-making.

AMFI's Initiatives: The Association of Mutual Funds in

India (AMFI), an industry body, has played a proactive

role in ensuring investor protection and market stability.

In a letter to fund houses, AMFI urged them to put in

place policies that protect investors, including

moderating inflows. Additionally, AMFI requested funds

to disclose the results of internal stress tests and details

on the time needed to liquidate portions of the portfolio

(25% or 50%). These disclosures are expected to be

made by the 15th of each month, providing investors with

crucial insights into the liquidity and risk management

strategies of the funds.

To address specific concerns, regulators are honing in on

critical areas:

Commissions: Some asset managers are proactively

reducing distributor commissions on small- and mid-cap

funds, contemplating additional costs for exiting

investors during substantial outflows. Regulators

propose temporary exit loads or swing pricing to manage

the impact of large fund outflows.

New small-cap stocks: Despite the surge in inflows and

returns, there's a cautious approach to adding new

small-cap stocks to portfolios. Regulators emphasize

the need for a vigilant assessment of segment growth

and diversification strategies.

Concentrated investment strategies: Regulators are

advising trustees to adopt proactive measures, such as

moderating inflows and rebalancing portfolios, to shield

investors from the potential negative impacts associated

with redeeming investors.

Small-cap funds have faced a balancing act recently.

Concerns about high valuations led some funds to limit

new investments. For instance, SBI Small Cap Fund

stopped accepting lump sums in 2020, followed by Tata

Small Cap Fund last year. Just recently, Kotak Small Cap

Fund announced restrictions, allowing only ₹25,000

monthly via SIP and a maximum ₹2 lakh lump sum

investment.

This success of small-cap funds, despite regulations and

market volatility, presents both opportunities and

challenges for investors. On the positive side, it

showcases the potential for exceptional returns in the

small-cap space, thanks to skilled fund management and

strategic stock picking. However, as the mutual fund

industry adapts under SEBI's regulations, investors are

reminded of the crucial role of informed decisions.

Aligning investments with your risk tolerance and

financial goals remains paramount.

Copyright © 2021 Fintso