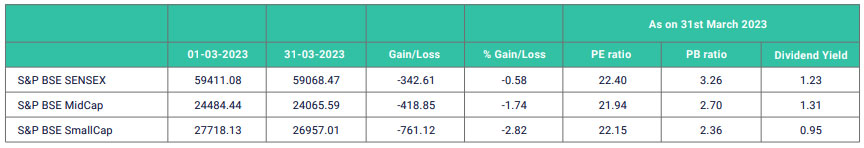

In the wake of US Fed Rate turmoil, geopolitical turbulences’, the Global banking crisis and rising inflation Indian share markets ends in red. In the coming months banking sector would experience pressure from the global banking crisis and the RBI regulatory pressure as precautionary measures to avert the global banking crisis effect on the Indian banking system. March being a month for tax planning and investment by retail investors reduce the money inflows into the market directly. The expectation of an abnormal monsoon with El Nino effect predictions for

the 2023 monsoon raised the concern over rural demand and upcoming market earnings. As the sectors which are expected to gain from current levels are tech stocks along with capex, engineering infrastructure, healthcare, and consumption. The new Finance Bill implications from 1st April 2023 also bring new dimensions to the financial scenario in India. Changes in various taxation norms initially would affect the investment styles of the investor and also changes the dynamics of money flow.

The debt Market over the month of March 2023 stayed volatile due to the

fed rate rise and inflation numbers. With the slight decrease in the US

inflation and banking sector turmoil, the yields played around. Moreover,

the banking crisis in Europe and China’s economic revival also added

uncertainty. The upcoming MPC meeting in the first week of April may

indicate RBI may hike rates by 25bps due to poor economic numbers. The

expected 10-year benchmark yield would stay in the range of 7.25% to

7.50% in the coming months. The debt mutual funds will attract LTCG

from 1st April 2023 onwards, this would change the perspective of mutual

fund investors toward shorter to medium-duration funds. Hope that the

inflation eases and hence the interest rates may not increase in the future.

Rupee was volatile through the month of March, with the US fed rate, the

global banking crisis and the low FPIs, rising crude prices, escalation in

the Ukraine-Russia war, and lastly the export numbers. The FPIs after the

US fed rate rise are looking at less risky currency getting better returns.

Exports are low due to recession in the other world economies.

Gold prices in India have been on the rise for the past few years and can

be attributed to uncertainties including the global economy, currency

fluctuations, and changes in demand as well as supply of gold. Metals in

the commodity market can provide a hedge against inflation and currency

devaluation. Better inflation numbers could provide support to Gold prices

but would be unstable to curb the interest rate changes.