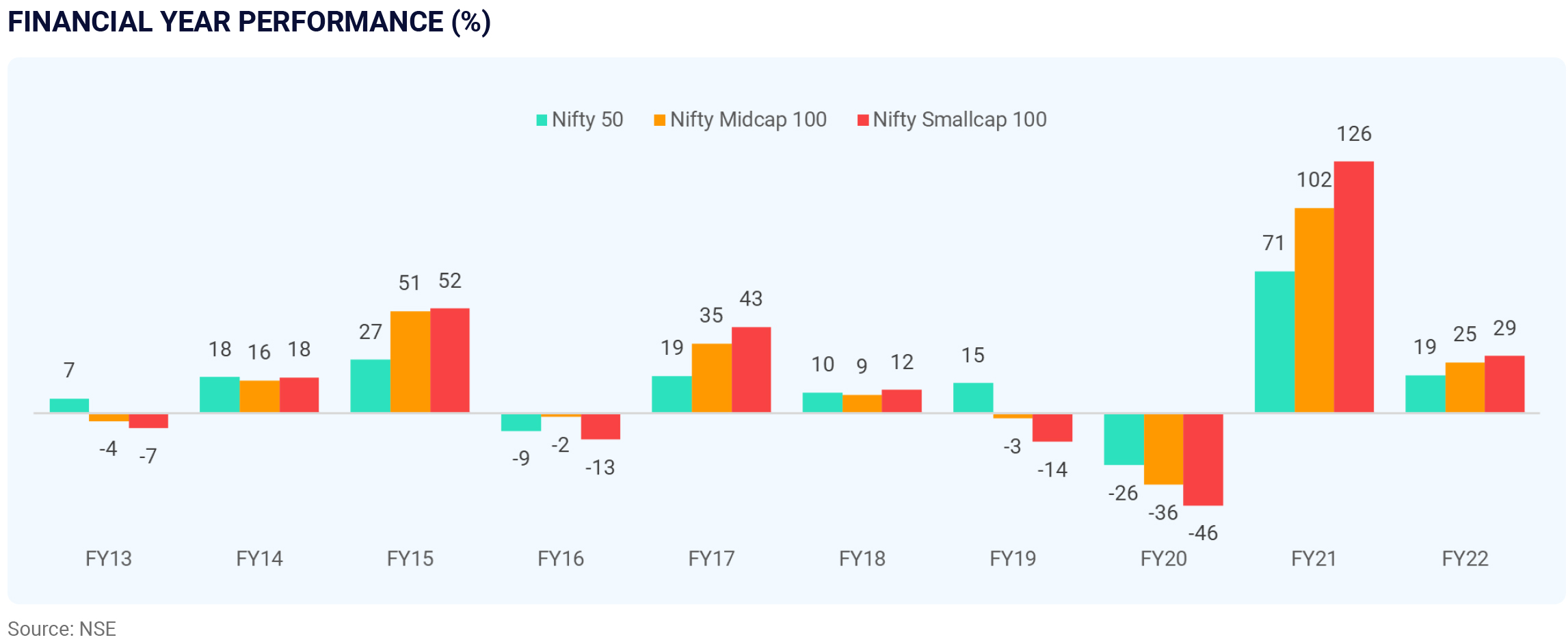

After a strong equity markets rally in FY21, the momentum continued, with the markets (as represented by Nifty 50 Index) surging another 19% in FY22. Both Nifty Midcap 100 (+25% YoY) and Nifty Smallcap 100 (+29% YoY) outperformed the large-cap segment. The positive sentiment continued for most of the year, led by a strong economic and earnings recovery. However, markets lost their sheen in the last quarter as Russia’s invasion of Ukraine destabilized the growth outlook, concerns of rising inflation, and heightened geopolitical risks.

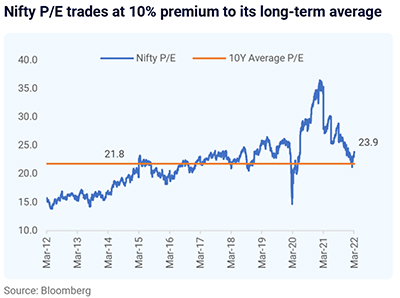

From a valuation perspective, market trades at a trailing PE (price to earnings) of 23.9x, a premium of 9.7% compared to its historical average of 21.8x.

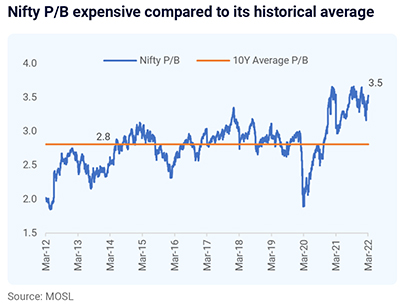

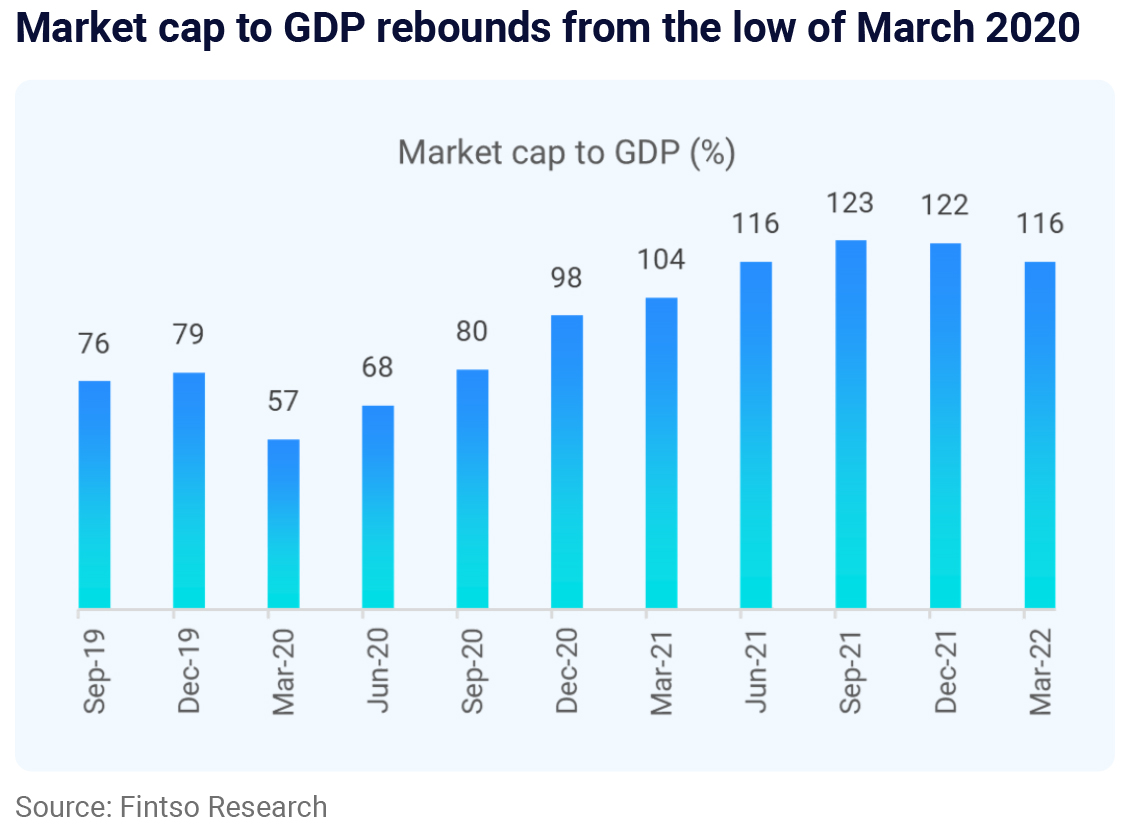

Also, PB (price to book) at 3.5x is at a 25.5% premium to its historical average. After touching a bottom of 56% in March 2020, the market capitalization to

GDP has rebounded to 116% (based on the latest GDP data available).

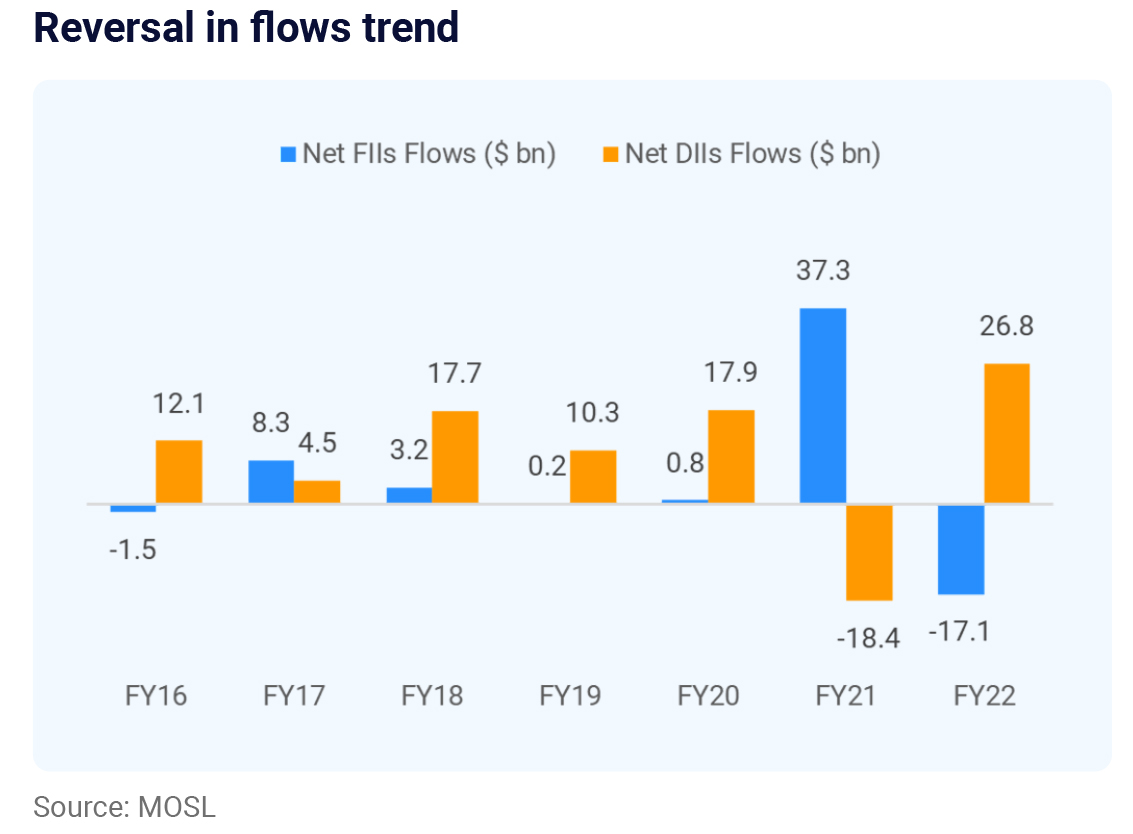

During the financial year, we witnessed a reversal in the flow trend. DIIs who have been net sellers in the last financial year turned out to be strong buyers

with record inflows at $26.6 bn, and FIIs turned net sellers after being net buyers last year.

As we step into the next financial year, we believe volatility will persist as some of the major central banks accelerate towards higher policy rates and

corporate margins start to get impacted due to rising inflation. As margins get impacted, companies shall pass on the higher prices to consumers, forcing

them to reduce discretionary spending. Also, China’s Covid-19 situation further augments the risk to the markets. The combination of input cost pressure

and slowing growth could lead to erratic earnings for FY23, especially for consumer-facing businesses. However, export-oriented businesses could benefit

from currency depreciation.

Given the headwinds for the market, we advise investors to consider staggering investments in equities through SIP or STPs. Also, if there is any major

market correction, we would recommend buying such DIPs as we believe that India has sustainable drivers for secular growth and continue to remain

bullish on equities from a long-term point of view.

To further reduce the risk, we recommend investing in 2-3 ELSS schemes. Based on our fund selection process that considers performance and fund management aspects, below is the list of our recommended ELSS schemes.

FIXED INCOME: ERA OF RISING INTEREST RATES

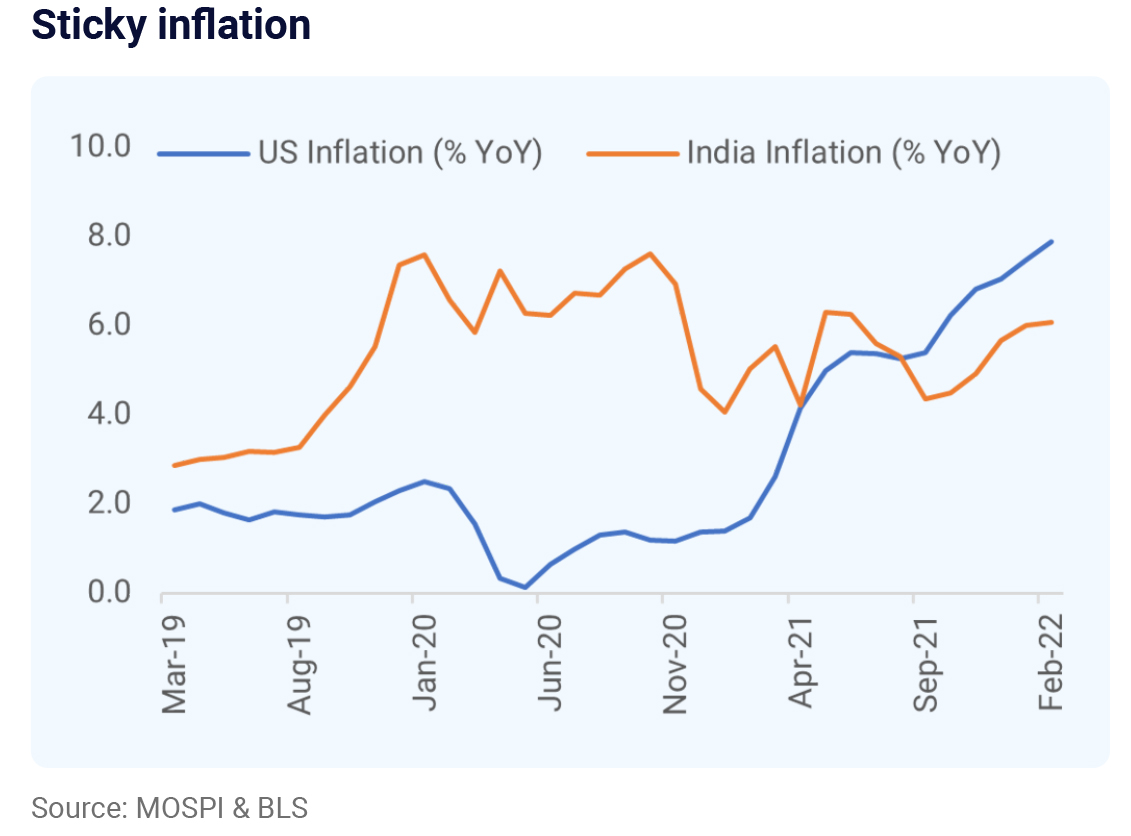

Interest rates in India and globally are expected to rise as retail inflation continues to remain elevated. While the RBI has maintained an accommodative

stance in its recent monetary policy, it would be difficult for them to continue to maintain this stance given the stickiness in the inflation rate. This would

put the RBI behind the curve in tackling inflation at a time when central banks across the globe are tightening policy to ease inflation pressure.

Also, the recent inversion of the US treasury yield curve resurfaces the risk of the global economy entering a recession. Also, Dow Jones Transportation

Average slipped into the bear market territory, another sign of bad news in store for the economy. Dow Jon Transportation Average tracks companies from

airlines, railroads, and trucking, which helps in gauging the health of the economy.

As we expect interest rates to be volatile, it is best to avoid funds investing in long-dated securities. Thereby, investors can consider investing in securities

with shorter maturity (short duration funds and banking & PSU funds). Also, one can consider investing in floater rate funds as returns are adjusted based

on prevailing yields in the market. Also, investors can look at target maturity funds if the investment horizon matches the target date. As target maturity

funds invest in G-Secs, SDLs, and PSU bonds, the default risk is very low.

Investors can continue to hold their investments in short (including money market) duration funds as we expect a limited impact on these funds for a given

change in interest rates. An investor invested in a long-duration fund can exit their holding after considering exit load and tax event.